Payroll Card Definition

The tax is based on wages salaries and tips paid to employees. Or they can go to a bank or ATM and withdraw money to get the cash.

Paychecks And Taxes Addison Finance Portfolio

Paychecks And Taxes Addison Finance Portfolio

Rather than getting paid through cash or a check employees receive their payments on a bank card.

/GettyImages-690719352-e869bdd35785476b8172436c9fee4b53.jpg)

Payroll card definition. Choose the correct definition for time card. Employees are not in charge of keeping track of their own working hours. It is typically handled by either the accounting department or the human resources department.

The use of a fleet card reduces the need to carry cash thus increasing the security for fleet drivers. The cards can make purchases at a point of sale and be used at ATMs to withdraw funds loaded on. The payroll card account may be held as a single bank account in the employers name.

Julia Chaudhari is the new payroll accountant for Insulose Chemicals. Pay cards work similarly to debit cards. PAY CARD meaning definition explanation.

A pay card or payroll card is a payment method where employers load employee net wages onto a prepaid card. A payroll register is the record for a pay period that lists employee hours worked gross pay net pay deductions and payroll date. An employer arranges with a bank or other financial institution to pay its employees with a payroll card.

What is Payroll. Also pay roll n. A payroll card is a prepaid card some employers use to pay their employees wages or salaries each payday.

The total sum of money to be paid out to employees at. This not only creates a document that the payroll clerk can use for preparing payroll it also creates an internal control. A payroll card is a prepaid card arranged by an employer for the purpose of paying its employees wages or salary.

Some payroll card programs. Fast convenient way to get your pay make purchases pay bills and help manage your money. The concept of payroll debit cards is simple.

A list of employees receiving wages or salaries with the amounts due to each. Videos you watch may be added to the TVs watch history and influence TV recommendations. In other words a payroll register is the document that records all of the details about employees payroll during a period.

A payroll card is also known as a pay card prepaid payroll card and a payroll debit card. A record of the time worked during a period for an individual employee. Payroll is the process of providing compensation to employees for their efforts on behalf of a business.

Payroll cards help employers save money by not having to issue printed checks and also. Payroll cards are essentially prepaid debit cards that are loaded up by employers every pay period. Payroll Card synonyms Payroll Card pronunciation Payroll Card translation English dictionary definition of Payroll Card.

If playback doesnt begin shortly try restarting your device. Fleet cards can also be used to pay for vehicle maintenance and expenses at the discretion of the fleet owner or manager. Employees can use the pay card like a debit card or they can withdraw wages through an ATM bank cashier or purchase where they receive cash back.

A pay card or payroll card is a prepaid card that employers can use to pay employees. The employees can then use that card to spend money like a credit or debit card. A fleet card is used as a payment card most commonly for gasoline diesel and other fuels at gas stations.

A clock card also called a time card is a source document that records the number of hours each employee works during a pay period. You can think of it as a summary of all the payroll activity during a period. Each payday the card is loaded with the employees wages for that pay period.

In that case the bank account holds the payroll funds for all employees of that company using the payroll card system and an intermediary limits each employees draw to an amount specified by the company for a specified pay period. A payroll card works the same way a debit or credit card or debit card does and is issued by the same payment processors that issue credit cards such as MasterCard and Visa. A payroll tax is a percentage withheld from an employees pay by an employer who pays it to the government on the employees behalf.

However only your employees paychecks can be put on the reloadable cards.

Paying Workers With Payroll Cards The 40 Billion Wage Violation You Ve Never Heard Of Skeptic At Law

Paying Workers With Payroll Cards The 40 Billion Wage Violation You Ve Never Heard Of Skeptic At Law

Presented By Andrew Boyadjian Industry Specialist Global Cash Card Ppt Download

Presented By Andrew Boyadjian Industry Specialist Global Cash Card Ppt Download

What Is A Paycard Sole Financial

What Is A Paycard Sole Financial

What Is A Pay Card Definition Regulations More

What Is A Pay Card Definition Regulations More

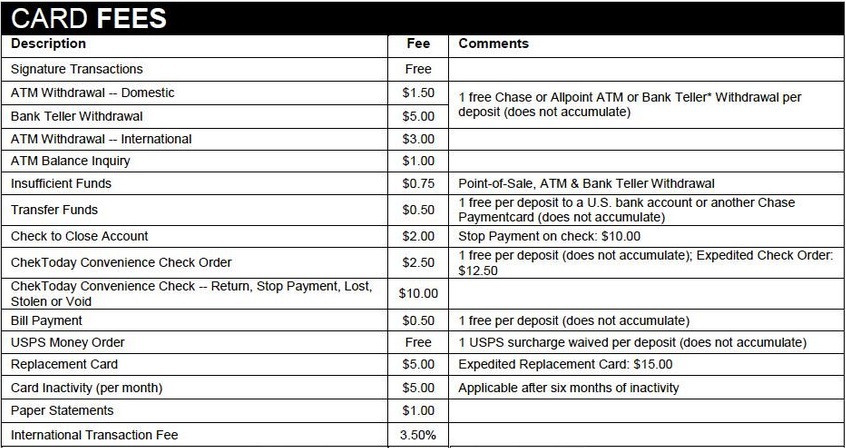

Payroll Card Definition Costs Paycard Providers Small Business Growth

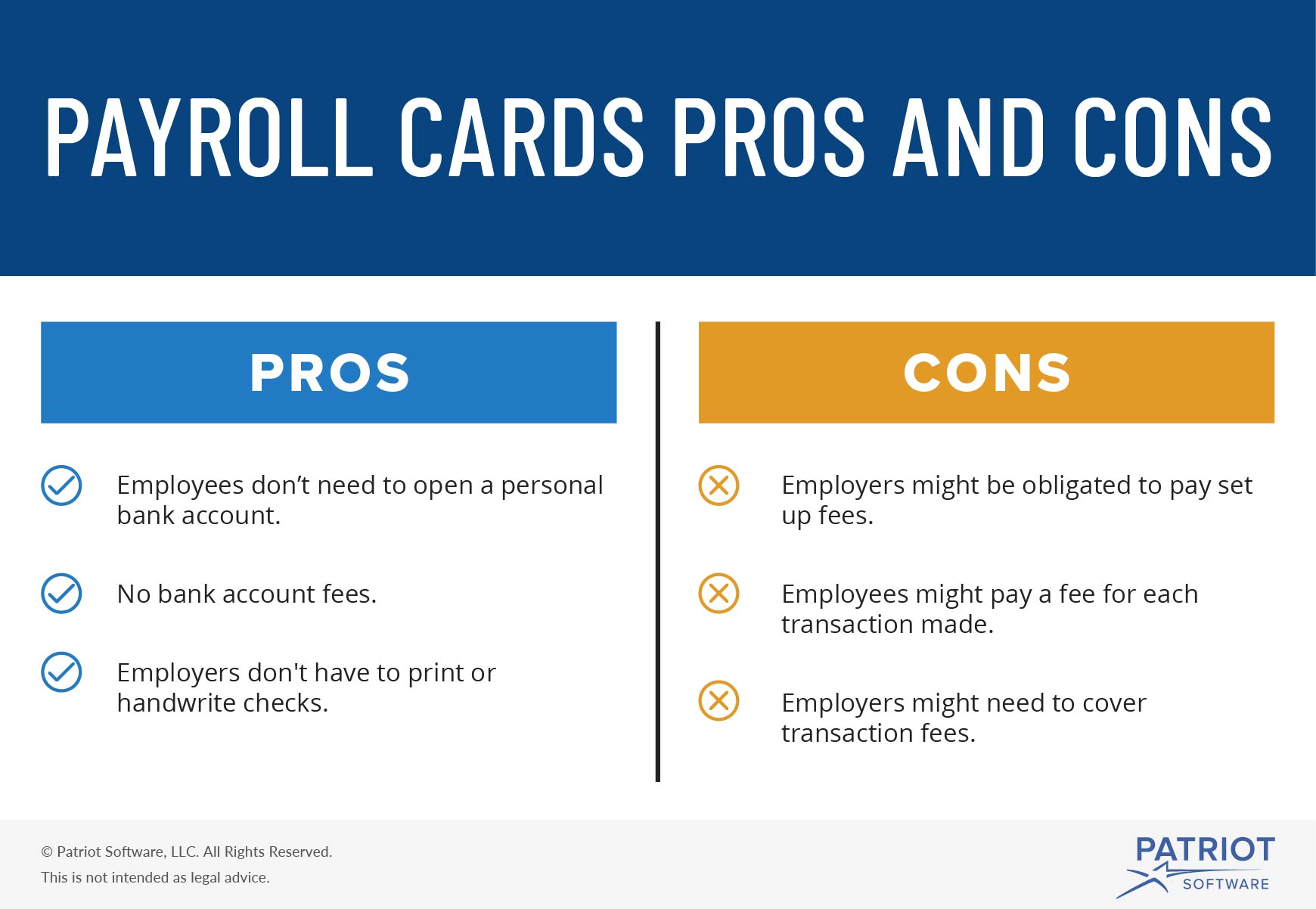

Direct Deposit Or Pay Card Pros Cons More

Direct Deposit Or Pay Card Pros Cons More

Objective 4 0 Understand Financial Services And Forms

Objective 4 0 Understand Financial Services And Forms

Annual Net Income Definition And How To Calculate Business Accounting

Payroll Card Definition Costs Paycard Providers Small Business Growth

Accounting Information System 12e Solutions Chapter End Problems By Lukka Issuu

Accounting Information System 12e Solutions Chapter End Problems By Lukka Issuu

100 Direct Deposit The Benefits Of Pay Cards

100 Direct Deposit The Benefits Of Pay Cards

Comments

Post a Comment