When Are Employers Required To Provide W2

Hopefully those forms will get to your employees. Is your employer legally obligated to give you your W2 form.

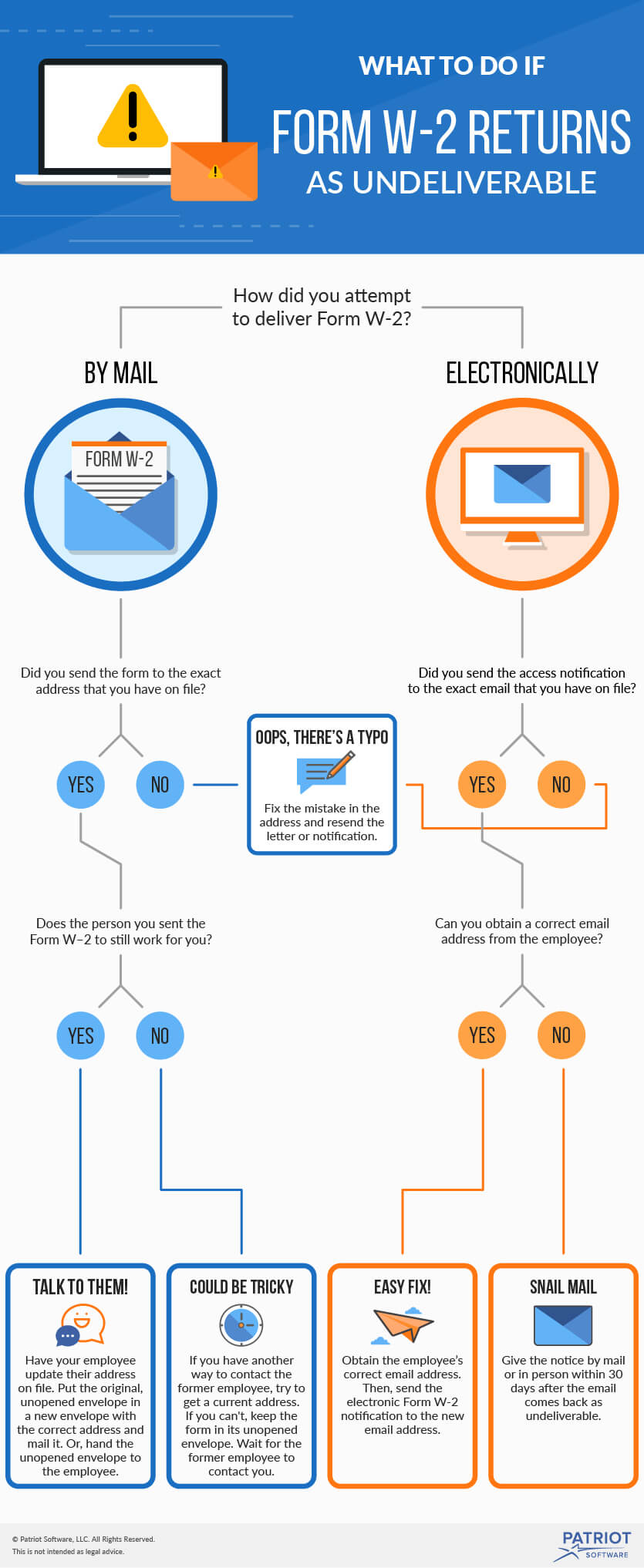

Form W 2 Returned To Employer Follow These Steps

Form W 2 Returned To Employer Follow These Steps

Regarding the W-2 Form Deadline your employer should issue W-2 Forms to you no later than Jan.

When are employers required to provide w2. Employers must furnish these copies of Form W-2 to employees from whom. If the employer does provide the employee with a notice of termination the notice must contain a statement that if the employee disagrees with any information in th e notice the. Employers must also withhold Medicare tax at 145 percent of gross compensation and an additional 09 percent of compensation in excess of a threshold amount based on the employees filing status if an employees compensation exceeds 200000 there is no wage base for Medicare.

Employers had until January 31st to have all forms put into the mail. But a smaller employer may choose to do so to save time and ensure accuracy. When calling be ready to give the following information.

Note that the e-filing threshold is reduced to 100 forms in 2021 and to 10 in 2022. I understand your employer wont release your W-2. The IRS requires that employers provide W2 forms to the government and employees by January 31.

Note that this doesnt mean youll receive your W2 by January 31. It just means that your employer must get it into the mail by that date. An employer must by law provide a W-2 to every employee who had wages in the prior calendar year not later than January 31 of the subsequent year.

He must either give it to you by January 31st of each year or it must be postmarked to the last known address of yours by January 31st. 31 so employees can use the information to file their federal and state income tax. If you dont receive your W-2 by the W-2 Form Deadline ask your employer for it.

Employers must file Copy A of Forms W-2 to the Social Security Administration by January 31st. Failure to comply can result in penalties. There are several ways you can distribute the forms including a way to do so electronically with the necessary employee-consent.

Under federal law employers must send employees their prior years W-2 statement by Jan. If you dont receive your W-2 by the W-2 Form Deadline ask your employer for it. Employers are required to distribute Form W-2s to their employees each year by the end of Januaryfor 2021 the deadline is February 1.

What happens if your employer doesnt give you a W2. Employers to provide employees with any documented notice of the employees termination of employment immediately upon termination of employment. Regarding the W-2 Form Deadline your employer should issue W-2 Forms to you no later than Jan.

An employer is REQUIRED to give you a completed Form W-2 for the calendar year by January 31st of the following year. Yes your employer is required legally to give you a W2 if he paid you 600 or more for the year. Returned W-2 Forms.

I would be happy to help you with that. If its past February 14 and you still dont have your W-2-Call the IRS for assistance at 800-829-1040. The employee may show the card if it is available.

If January 31st falls on a Saturday Sunday or legal holiday the deadline will be the next business day. Legal Limitations Of W-2 Forms. The employer may choose to deliver the completed W-2 in a manner other than postal mail.

Copies of W-2s must be transmitted to the Social Security Administration SSA electronically if the company is required to file 250 or more W-2s for 2019 in 2020. The employer may deliver the form to employees in person by mail or only if the employee consents by electronic distribution. But some forms might come back to you as undeliverable especially if you.

You can also check our database to find your W-2 onlineand have it. Michele Bossart Jan 16 2017 Every year you are required to send Form W-2 to employees by the January 31 Form W-2 filing deadline. The IRS will contact your employer to issue W-2 Form that is missing.

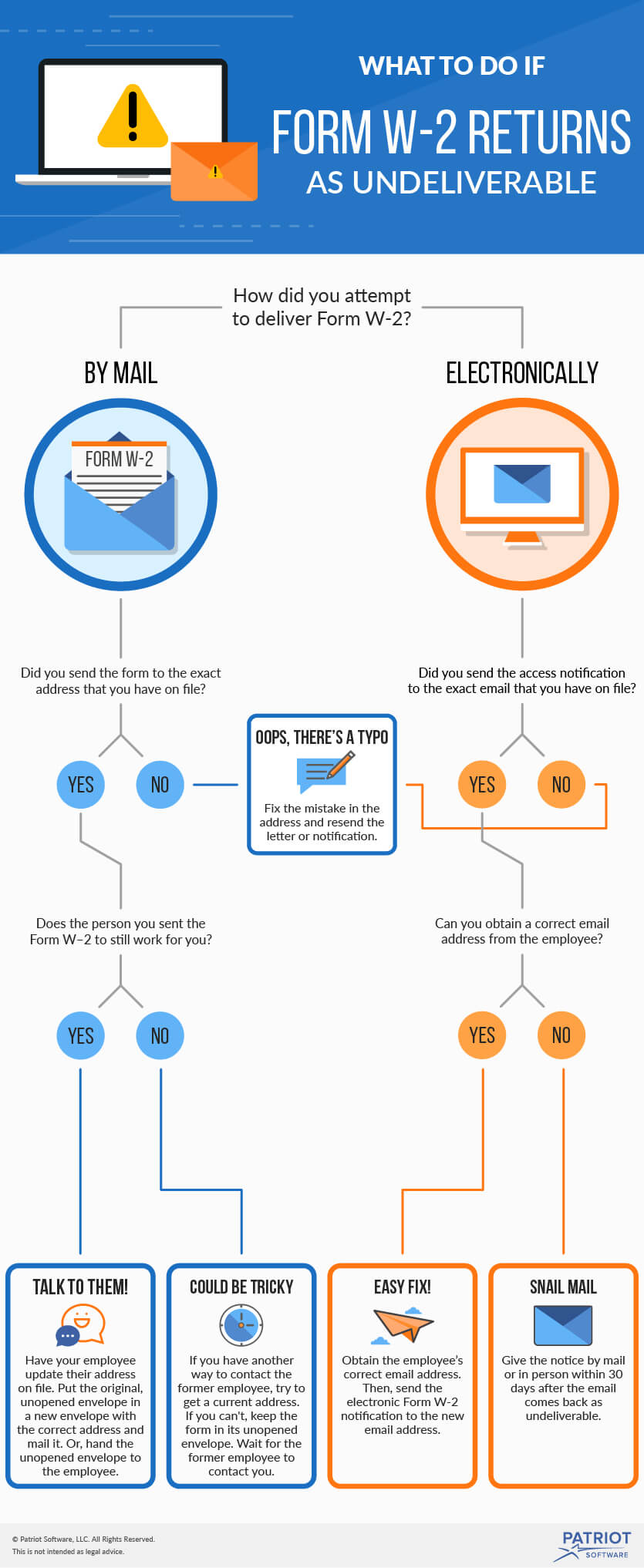

You are required to get each employees name and Social Security number SSN and to enter them on Form W-2. A 2020 Form W-2 must be postmarked to you by February 1 2021. Employers must furnish Copies B C and 2 of Form W-2 to employees by January 31.

This requirement also applies to resident and nonresident alien employees You should ask your employee to show you his or her social security card.

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

Wage Tax Statement Form W 2 What Is It Do You Need It

Wage Tax Statement Form W 2 What Is It Do You Need It

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

What Is A W 2 How To Get A Wage Tax Statement Nerdwallet

What Is A W 2 How To Get A Wage Tax Statement Nerdwallet

Is Your Employer Legally Obligated To Give You Your W2 Form Quora

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

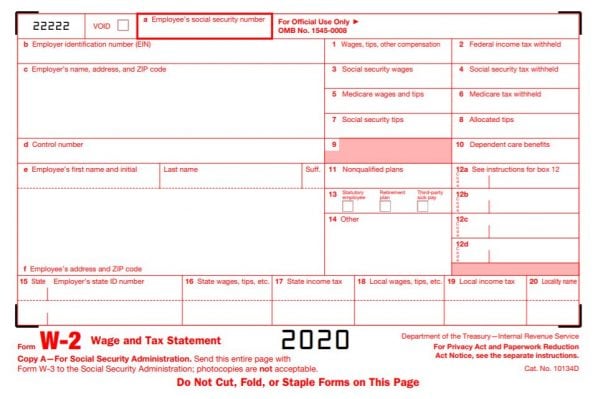

:max_bytes(150000):strip_icc()/Clipboard01-779726998cf64e9085a5319a27cc25f4.jpg) Form W 2 Wage And Tax Statement Definition

Form W 2 Wage And Tax Statement Definition

Understanding Form W 2 A Guide To The Wage Tax Statement Ageras

Understanding Form W 2 A Guide To The Wage Tax Statement Ageras

:max_bytes(150000):strip_icc()/Screenshot67-7402a2c526044f42870800de6086e1e1.png)

/understanding-form-w-2-wage-and-tax-statement-3193059-v4-5bc643e646e0fb0026d3aafc-5c0ab974c9e77c000168e8d4-aa8231daf99c4a29b2eea9e58e5fdca8.png)

Comments

Post a Comment