Notes Receivable Accounting

Apply Today Limited Seats. The other party will have a note payable The principal part of a note receivable that is expected to be collected within one year of the balance sheet date is reported in the current asset section of the lenders balance sheet.

Accounting For Notes Receivable Explanation Journal Entries And Example Sitename

Accounting For Notes Receivable Explanation Journal Entries And Example Sitename

Accounting for Notes Receivable.

Notes receivable accounting. Ad Apply for jobs across top companies locations for accounting bookkeeping in UK. Accounts receivable is an informal agreement between customer and company with collection occurring in less than a year and no interest requirement. Notes Receivable are assets shown on the Balance SheetStatement of Financial Position.

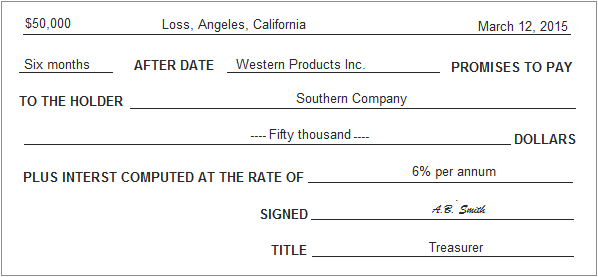

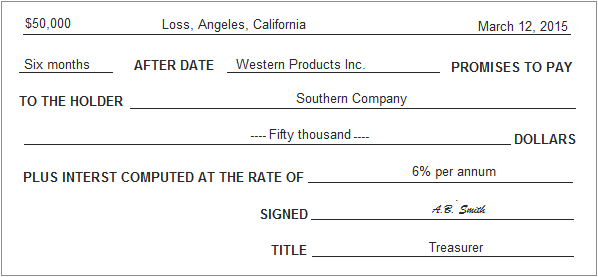

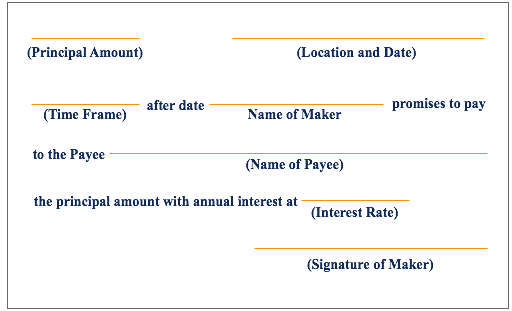

In other words a note receivable is lenders contract with the borrower. Notes receivable definition An asset representing the right to receive the principal amount contained in a written promissory note. The contracts typically outline the terms of payment payment dates and interest rates.

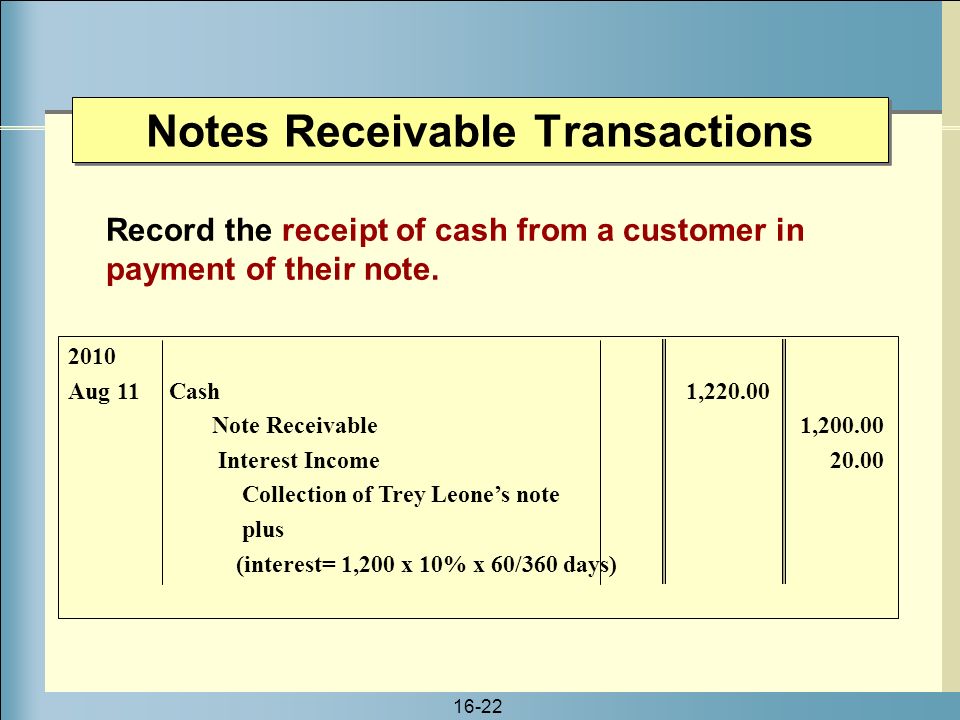

The credit can be to Cash Sales or Accounts Receivable depending on the transaction that gives rise to the note. Ad Apply for jobs across top companies locations for accounting bookkeeping in UK. Two types of notes receivable Interest-bearing note Noninterest-bearing note.

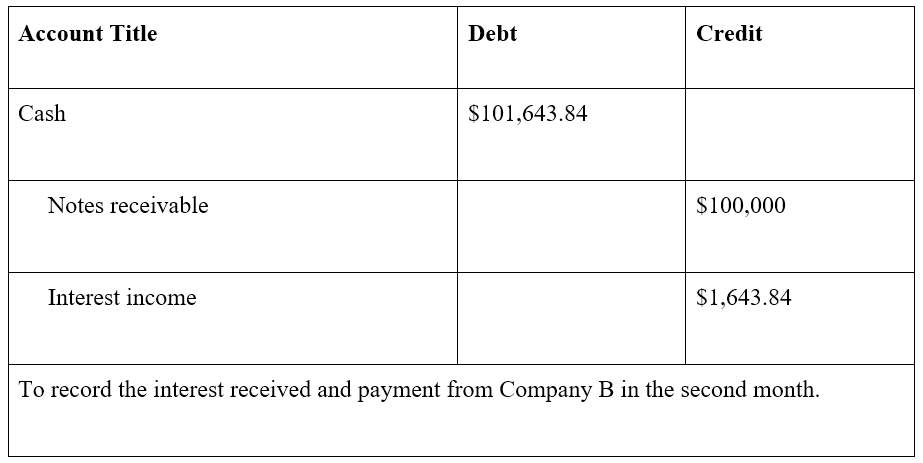

On the balance sheet of the lender payee a note is a receivable. Principal that is to be received within one year of the balance sheet date is reported as a current asset. Notes receivable are different from accounts receivable because they are formally documented and signed by the promising party known as the maker of the.

A customer may give a note to a business for an amount due on an account receivable or for the sale of a large item such as a refrigerator. A written promise from a client or customer to pay a definite amount of money on a specific future date is called a note receivable. Home Accounting Dictionary What is a Note Receivable.

Notes receivable is a written promise by a supplier agreeing to pay a sum of money in the future. A written promissory note gives the holder or bearer the right to. When a note is received from a customer the account Notes Receivable is debited.

Overdue accounts receivable are sometimes converted into notes receivable thereby giving the debtor more time to pay while also sometimes including a personal guarantee by the owner of the debtor. In any event the Notes Receivable account is at the face or principal of the note. They are usually contracts specifying money owed to the company by its debtors.

Apply Today Limited Seats. Holder of the note will receive interest payment in addition to the face amount of the note. In contrast notes receivable is a legal contract with collection occurring typically over a year and interest requirements.

A note receivable is a written promise to receive a specific amount of cash from another party on one or more future dates. Also a business may give a note to a supplier in exchange for merchandise to sell or to a bank or an individual for a loan. Such notes can arise from a variety of circumstances not the least of which is when credit is extended to a new customer with no formal prior credit history.

Notes receivable are a balance sheet item that records the value of promissory notes Promissory Note A promissory note refers to a financial instrument that includes a written promise from the issuer to pay a second party the payee that a business is owed and should receive payment for. Accounting for Note Receivable. UK Hiring Bookkeeper Assistant Accountant.

Notes receivable is an asset of a company bank or other organization that holds a written promissory note from another party. UK Hiring Bookkeeper Assistant Accountant. Accounts Receivable vs Notes Receivable.

Accounts receivable is the funds owed by the customers. Receivable represented by promissory notes Promissory notes indicate the face amount and due date. These Notes can be issued at a prem.

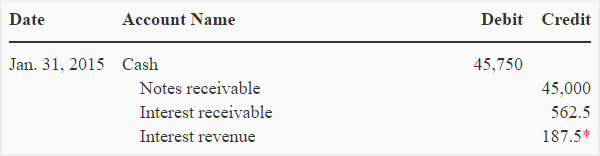

Notes receivable are financial assets of a business which arise when other parties make a documented promise to pay a certain sum on demand or on a specific date. Suppose in the above example if Southern company fails to make the payment of 45750 the Western company will make the following entry. What distinguishes notes receivables from accounts receivable is that they are issued as a promissory note a formal legal agreement given as a written note promising to pay principal plus interest at a specific date.

This is treated as an asset by the holder of the note. What are Notes Receivable. Notes receivable are assets and represent amounts due to a business by a third party usually a customer.

Notes receivable may be short term or long term. A note receivable is a written promise to receive a specific amount of money at a designated future date or on demand of the holder. Definition of Notes Receivable.

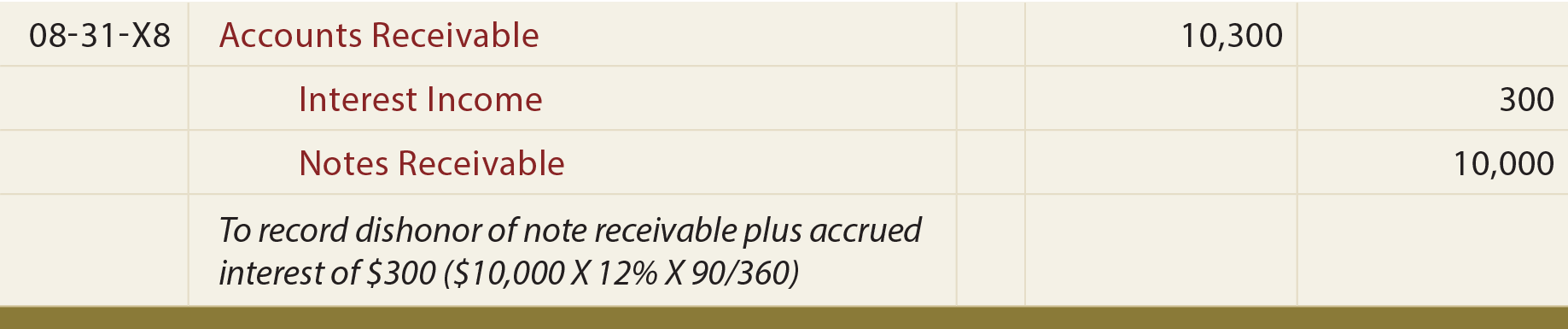

A defaulted note is worthless therefore the amount due from notes receivable is immediately transferred to accounts receivable. Accounts receivable is a short term asset. Notes Receivable definition.

Learn The Definition Of Other Receivables Online Accounting

Learn The Definition Of Other Receivables Online Accounting

Notes Receivable In Accounting Double Entry Bookkeeping

Notes Receivable In Accounting Double Entry Bookkeeping

What Are Notes Receivable Examples And Step By Step Guide

What Are Notes Receivable Examples And Step By Step Guide

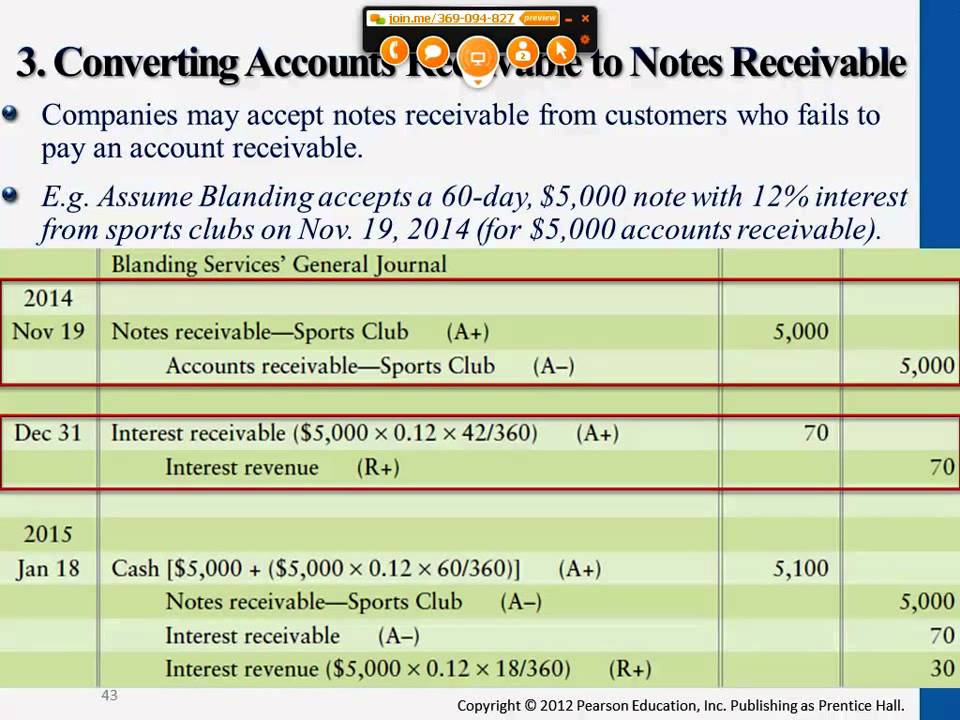

Converting Accounts Receivable To Notes Receivable Youtube

Converting Accounts Receivable To Notes Receivable Youtube

Notes Receivable Definition Journal Entries Examples Play Accounting

Notes Receivable Definition Journal Entries Examples Play Accounting

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

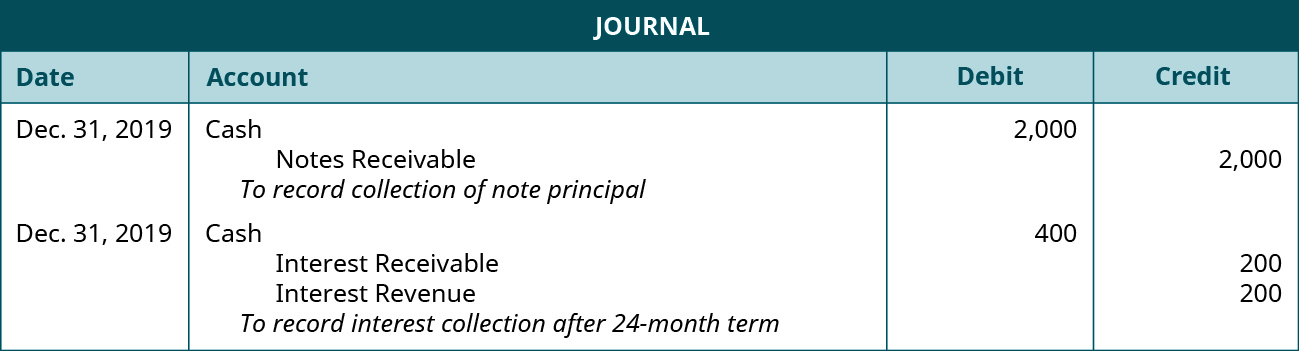

Explain How Notes Receivable And Accounts Receivable Differ Principles Of Accounting Volume 1 Financial Accounting

Explain How Notes Receivable And Accounts Receivable Differ Principles Of Accounting Volume 1 Financial Accounting

Notes Receivable Accounting Definition Journal Entry Example T Account

Notes Receivable Principlesofaccounting Com

Notes Receivable Principlesofaccounting Com

Converting Accounts Receivable To Notes Receivable Explanation Format And Benefits Accounting For Management

Converting Accounts Receivable To Notes Receivable Explanation Format And Benefits Accounting For Management

Explain How Notes Receivable And Accounts Receivable Differ

Explain How Notes Receivable And Accounts Receivable Differ

What Are Notes Receivable Examples And Step By Step Guide

What Are Notes Receivable Examples And Step By Step Guide

Comments

Post a Comment